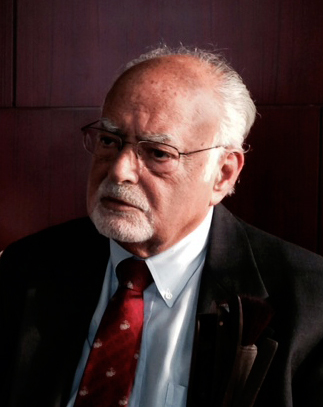

By Arthur Lipper

I am a serial entrepreneur and the former owner, publisher and Editor-In-Chief of Venture, The Magazine for Business Owners and Entrepreneurs.

One of the primary reasons to become a business owner is to profit from ownership of the business if it becomes successful, and to have the benefits and perks of ownership.

One of the primary reasons to become a business owner is to profit from ownership of the business if it becomes successful, and to have the benefits and perks of ownership.

But once you have sold any of your shares, you are the controlling shareholder, and you have fiduciary responsibilities to the minority shareholders. Your personal financial interests and those of the other shareholders inevitably come into conflict.

For example — should the company lease a Mercedes or a Honda for the CEO? Should the CEO take his wife to conventions? Does the CEO need artwork in his office? Should the company sell out, merge or acquire a competitor? How much compensation, and in what form, should be paid the CEO? Is it reasonable for the company to pay life insurance premiums for the CEO if he is no longer the sole proprietor of the company? Are short-term profits more important than the strategic positioning of the company, if some of the shareholders want the company to go public?

These and hundreds of other issues may arise between the majority owner of the business and minority shareholders.

Also, in dealing with venture capitalists, the business owner must accept that they will want to influence, if not ultimately control the company. Though their advice can be helpful, VC’s will never have the in-depth knowledge or insight of the founding entrepreneur — yet they will frequently assert their views and/or block actions the business founder believes appropriate.

The entrepreneur’s original intent is either to build an independent company for the future, or to create a flipper, which is intended to be sold within a short period of time. The issue of keeper versus flipper should be uppermost in the mind of the entrepreneur when deciding on the company’s capital structure.

Another consideration is the degree of confidence on the part of the business owner about the earning power of the company. If the business founder fully believes in the projected future profitability of the company, then an alternative to the sale of equity should be sought — possibly a royalty on the company’s gross revenues. When the company is successful as projected, the trade-off between a slightly lower profit margin and greater equity ownership clearly favors greater ownership.

Royalties — the sale by a company of a percentage of its future revenues — is a better method for a confident business owner to acquire capital, since it avoids equity dilution. This capital structure is also better for investors — since it avoids the conflicts described above and focuses the ROI directly on current revenues, not on the speculative, deferred benefits of ownership.

I have been involved in and observed hundreds of private company financings, so I know that in most cases of business success, the business founder regretted having sold equity early in the company’s life, especially on typical VC terms. In the case of business disappointments, the original entrepreneur was usually no longer in charge and frequently no longer in the company.

Royalties are the better way, both of investing in and financing privately owned companies.

Arthur Lipper, Chairman

British Far East Holdings Ltd.